News Center

A new type of electronic materials company that is based on independent research and development, integrating development, production, sales, and service.

The competition in the photovoltaic ALD equipment market is intensifying. Does Micro have a chance in the semiconductor sector?

Release time:

2020-12-22

As a high-end equipment supplier, Micro导纳米's ALD equipment has gradually been applied in the photovoltaic field and has achieved a certain market share. However, compared to its listed peers, it has relatively few customers, and its product sales are far below those of its peers; at the same time, its customer concentration is relatively high, leading to high accounts receivable, which has affected its normal capital turnover and debt repayment ability.

In order to enhance the company's risk resistance, Micro导纳米, which has initiated an IPO, is actively exploring the integrated circuit market to expand its business scale. However, the barriers in the integrated circuit equipment field are relatively high, and the market is largely monopolized by foreign giants. As a 'latecomer,' what chances does Micro导纳米 have in terms of technology accumulation and market development?

Product sales are not on the same level as peers.

Since 2010, the global solar photovoltaic industry has entered a period of rapid development, with the annual installed capacity of solar photovoltaics growing rapidly, and the upstream thin-film equipment industry has also developed swiftly. The broad market prospects have attracted many companies to enter the field, including Micro导纳米, which was established in 2015.

On the basis of ensuring film-forming performance, Micro导纳米 has broken through the limitations of ALD technology in terms of unit capacity and equipment costs, significantly reducing the costs of key process equipment and production in the manufacturing process of crystalline silicon solar cells in the photovoltaic field, leading to a further decrease in the equipment investment and production consumption of crystalline silicon solar cell manufacturers.

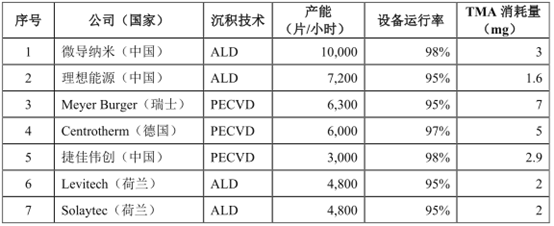

According to the data parameter comparison between the Swiss MeyerBurger company's MAiA2.1 model and Micro导纳米's KF6000 model, under the condition of an annual capacity of 1 GW, the price advantage of using Micro导纳米's KF6000 equipment is about 5 million yuan, and the full capacity TMA consumption advantage is about 6.6226 million yuan, with a total cost advantage of 11.6226 million yuan. Micro导纳米 claims that while ensuring the same level of process realization, the downstream user cost reduction advantage brought by the product has allowed the company's equipment to quickly seize the market, achieving domestic substitution for imported products.

Subsequently, through continuous technological optimization and new process development, Micro导纳米's equipment capacity has continued to break through, with an average capacity of 10,000 pieces/hour and a maximum capacity of 12,000 pieces/hour. According to TaiYangNews data, compared to well-known domestic and foreign manufacturers, Micro导纳米's Al2O3 deposition coating equipment capacity and equipment operating rate are superior to those of international similar equipment, with TMA utilization and other indicators reaching the advanced level of international similar equipment.

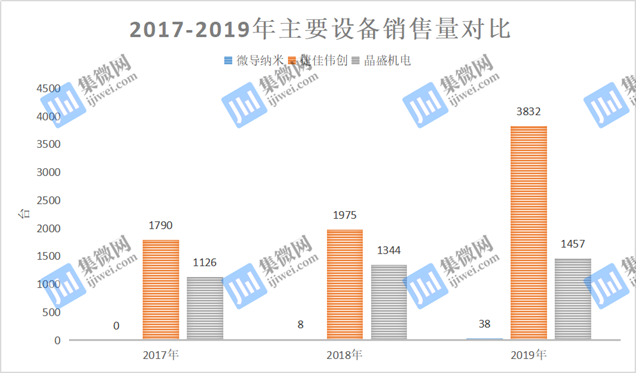

With a relatively high cost-performance ratio, Micro导纳米 has established cooperative relationships with companies such as Tongwei Solar, Trina Solar, JA Solar, and Canadian Solar, and its ALD equipment sales have also achieved steady growth. From 2017 to 2019, Micro导纳米's main equipment sales were 0 units, 8 units, and 38 units, showing an annual increase.

(The above data is extracted from the annual reports of various companies and calculated. Among them, Micro导纳米's comparable business is extracted from the prospectus 'ALD equipment,' Jiejia Weichuang's comparable business is extracted from its annual report 'solar cell production equipment,' and Jing Sheng Electromechanical's comparable business is extracted from its annual report 'crystal growth equipment' business.)

Compared to its peers, Micro导纳米's product sales are very low.

During the reporting period, Jiejia Weichuang's sales were 1,790 units, 1,975 units, and 3,832 units; Jing Sheng Electromechanical's sales were 1,126 units, 1,344 units, and 1,457 units. In terms of comparable product sales, there is a significant gap between Micro导纳米 and Jiejia Weichuang, Jing Sheng Electromechanical.

In addition, Micro导纳米's product production and sales rate is also relatively low. In 2018 and 2019, Micro导纳米's production and sales rates were 11.94% and 76%, overall lower than those of comparable peers. Micro导纳米 states that during the reporting period, the production of its ALD equipment was generally higher than sales, mainly because the company's equipment products need to be installed, debugged, and trial-operated on the customer's production line after being dispatched, and revenue can only be confirmed after customer acceptance, which has a long acceptance cycle, thus leading to a certain lag in the matching of production and sales during the period.

Although Micro导纳米 claims that the low production and sales volume is affected by the long verification cycle of ALD equipment, the author observes that due to Micro导纳米's late start, compared to comparable peers, it is at a disadvantage in terms of product line layout, patent quantity, etc., leading to relatively fewer customer accumulations, resulting in high customer concentration, which in turn affects its payment ability.

High accounts receivable affect debt repayment ability.

The prospectus shows that from 2018 to 2019, Micro导纳米's operating income was 41.9106 million yuan and 215.8156 million yuan, respectively. Among them, the sales amount of the top five customers was 41.8626 million yuan and 128.6890 million yuan, accounting for 99.90% and 59.64% of the operating income for the period, respectively, indicating a high customer concentration.

Micro导纳米 also frankly states that the crystalline silicon solar cell industry has a high concentration, and the company entered the industry later and is smaller in scale, which leads to a significant disadvantage in terms of brand, resulting in relatively fewer customer accumulations and high customer concentration, thus affecting its payment ability.

From 2018 to 2019, Micro导纳米's accounts receivable book amounts were 13.1571 million yuan and 72.3092 million yuan, accounting for 31.39% and 33.51% of the operating income for the period, respectively. The comparable company Jiejia Weichuang's accounts receivable accounted for 20.05% and 15.33% of the operating income for the same period in 2018 and 2019, showing a year-on-year decline. In contrast, Micro导纳米's accounts receivable are high and show an increasing trend.

Among them, in 2018 and 2019, the accounts receivable amounts of Micro导纳米's top five customers were 13.1571 million yuan and 53.4445 million yuan, accounting for 100% and 73.91%, respectively. Strengthening cooperation with major customers is undoubtedly beneficial to the company, but it has also gradually formed a dependence on major customers, which has led to a decline in Micro导纳米's payment ability.

Although Micro导纳米's customers are mainly leading companies in the industry with relatively good credit status, as the business scale expands, Micro导纳米's accounts receivable may further increase, and there may be situations where accounts receivable cannot be recovered on time or cannot be collected, resulting in bad debts, thereby reducing Micro导纳米's income and increasing collection costs, causing certain losses in its performance.

In terms of accounts receivable turnover rate, Micro导纳米 is also not as good as the comparable listed company Jiejia Weichuang. In 2018, Micro导纳米 and Jiejia Weichuang's accounts receivable turnover rates were 6.37 and 6.31, respectively, with not much difference between the two companies. By 2019, Jiejia Weichuang's accounts receivable turnover rate was 7.35, while Micro导纳米's accounts receivable turnover rate was only 5.05. The decrease in its accounts receivable turnover rate indicates that too much working capital is stagnant in accounts receivable, affecting normal capital turnover and debt repayment ability.

The author notes that in the context of broad market prospects, Micro导纳米 will face many competitors, and market competition is becoming increasingly fierce. The author believes that if Micro导纳米's products or services cannot meet customer needs, or if some customers operate poorly or choose other technical routes, thereby reducing their procurement of the company's products, it will affect the company's financial performance.

Expand the integrated circuit equipment field

Perhaps realizing that there will be fierce market competition in the photovoltaic field, MicroGuide Nano will expand the integrated circuit market to increase the scale of the company's business and enhance the company's risk resistance.

At the same time, in order to accelerate the layout in the integrated circuit field, MicroGuide Nano plans to raise 500 million yuan to invest in integrated circuit-related projects. Among them, 282 million yuan will be invested in the expansion project of 120 units of photovoltaic, flexible electronics, and semiconductor equipment based on atomic layer deposition technology, and 118 million yuan will be invested in the industrial application center project for high-end integrated circuit equipment. Both projects have a construction period of 2 years.

MicroGuide Nano stated that in recent years, industries such as photovoltaics and integrated circuits have been booming, and the ALD equipment, as a technical carrier, also has strong market demand. This fundraising project aims to expand existing production capacity to meet the growing market demand for ALD equipment. The project construction has good economic and social benefits, which is conducive to the company increasing its market share and achieving sustainable and stable development.

However, integrated circuit equipment has high technical and market barriers. Currently, Lam Research, ASM International, Applied Materials, and Tokyo Electron are strong comprehensive manufacturers in the semiconductor equipment field, all of which have certain first-mover advantages, mature product lines, and considerable market share. According to data from the Future Think Tank, in the high-end ALD equipment field, the market is basically monopolized by ASM (29%), TEL (27%), and Lam (20%).

Among domestic manufacturers, North Huachuang and Shenyang Tuojing are also accelerating the layout of ALD equipment in the semiconductor field and have made certain progress. In 2017, North Huachuang's Polaris A630 ALD equipment successfully entered the Shanghai Integrated Circuit Research and Development Center Co., Ltd. through public bidding. This equipment is mainly used for depositing high dielectric constant and metal gate thin film materials in integrated circuit devices, and the core technical indicators of the equipment have reached international advanced levels. It is understood that the Polaris A630 ALD equipment took four years from development to mass production, which is relatively long.

In addition, the Shenyang Tuojing atomic layer deposition (ALD) equipment (FT-300T) project also passed the evaluation of scientific and technological achievements in 2019. This project has been granted 12 authorized patents, including 7 invention patents, and has independent intellectual property rights. Shenyang Tuojing stated that applications from users such as the Shanghai Integrated Circuit Research and Development Center Co., Ltd. indicate that the company's product performance is stable and meets the process requirements of mainstream production lines.

As a "latecomer," MicroGuide Nano is not only far behind international giants in terms of integrated circuit technology accumulation and market development, but also has a significant gap compared to domestic companies. Currently, MicroGuide Nano plans to enhance the company's technical research and development capabilities, analytical testing capabilities, and provide an environment that meets the research and development and production standards of integrated circuit equipment through the fundraising project, in order to meet customer demands for high-standard products and high-quality services.

MicroGuide Nano also admits that the semiconductor integrated circuit field has strict requirements for various indicators of equipment and processes, with high industry barriers and long product introduction cycles. However, if the company's product performance and service levels cannot meet customer requirements, or if other reasons lead to the promotion effect of integrated circuit products being lower than expected, it may adversely affect the company's operations.

Focus on hot spots